Refund Policy, Requirements for Withdrawal, and Return of Title IV

Refund Policy

For applicants who cancel enrollment or students who withdraw from enrollment a fair and equitable settlement will apply. The following policy will apply to all terminations for any reason, by either party, including but not limited to student decision, course or program cancellation, or school closure. Any monies due the applicant or students shall be refunded within 40 days of official cancellation or withdrawal.

- All fees and payments, except the non-refundable application fee, remitted to the school by a prospective student shall be refunded if the student does not enroll in the school, does not begin the program or course, with-draws prior to the start of the program, or is dismissed prior to the start of the program. Applicants who have not been accepted for admission will be notified via an emailed denial letter and refunded the application fee within 40 days from the date of application submission.

- The school shall provide a period of at least three business days, excluding weekends and holidays, during which a student applicant may cancel his enrollment without financial obligation other than the nonrefundable application fee.

- Following the period described in section 2 above, a student applicant (who has applied for admission) may cancel, by written notice, his enrollment at any time prior to the first class day of the session for which application was made. When cancellation is requested under these circumstances, the school is required to refund all tuition paid by the student less the nonrefundable application fee. A student applicant will be considered a student as of the first day of classes.

- The date of the institution's determination that the student withdrew should be no later than 14 calendar days after the student's last date of attendance as determined by the institution from its attendance records. After 14 calendar days, the institution is expected to have determined whether the student intends to return to classes or to withdraw. In addition, if the student is eventually determined to have withdrawn, the end of the 14-day period begins the timeframe for calculating the refunds. In the event that a written notice is submitted, the effective date of termination shall be the date of the written notice. The school may require that written notice be transmitted via registered or certified mail, or by electronic transmission, or in writing per the Refund Policy in the enrollment contract. The school is required to submit refunds to individuals who have terminated their status as students and are due a refund per the institutional Refund Policy, within 40 days after receipt of a written request or the date the student last attended classes whichever is sooner.

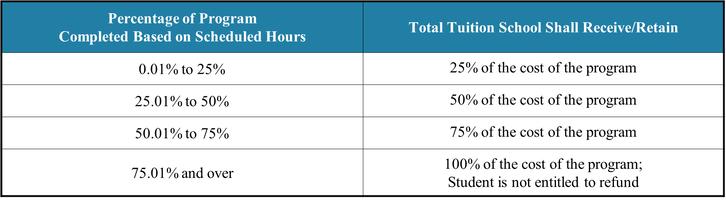

- For students who enroll and begin classes but withdraw prior to course completion. The following schedule of tuition earned by the school applies. For students receiving financial aid, a Return of Title IV calculation will be performed prior to the institutional refund policy. All refunds are based on scheduled hours:

6. Fractions of credit for courses completed shall be determined by dividing the total amount of time required to complete the period or

the program by the amount of time the student actually spent in the program or the period, or by the number of correspondence course

lessons completed, as described in the contract.

7. Expenses incurred by students for instructional supplies, tools, activities, library, rentals, service charges, deposits, and all other charges

are not required to be considered in tuition refund computations when these expenses have been represented separately to the student

in the enrollment contract and catalog, or other documents, prior to enrollment in the course or program. The school shall adopt and

adhere to reasonable policies regarding the handling of these expenses when calculating the refund.

8. I understand that in the event of any dispute arising out of this agreement on services hereunder, the courts of the Circuit Court of the

City of Virginia Beach have sole and exclusive venue. I further agree that should the school prevail on any dispute regarding this

agreement, the school shall be entitled to recover its attorney’s fees, and if the matter involves collection, 25% of the amount of the

outstanding shall be agreed to be reasonable

the program by the amount of time the student actually spent in the program or the period, or by the number of correspondence course

lessons completed, as described in the contract.

7. Expenses incurred by students for instructional supplies, tools, activities, library, rentals, service charges, deposits, and all other charges

are not required to be considered in tuition refund computations when these expenses have been represented separately to the student

in the enrollment contract and catalog, or other documents, prior to enrollment in the course or program. The school shall adopt and

adhere to reasonable policies regarding the handling of these expenses when calculating the refund.

8. I understand that in the event of any dispute arising out of this agreement on services hereunder, the courts of the Circuit Court of the

City of Virginia Beach have sole and exclusive venue. I further agree that should the school prevail on any dispute regarding this

agreement, the school shall be entitled to recover its attorney’s fees, and if the matter involves collection, 25% of the amount of the

outstanding shall be agreed to be reasonable

termination

The institution considers the following as grounds for immediate termination of enrollment including but may not be limited to:

The refund policy applies to all terminations for any reason.

- Failure to comply with clinic assignments, attendance and/or grade requirements

- Noncompliance with general policies, signed enrollment contract, state laws and regulations, improper conduct; any negative/disrespectful comments; behavior that is considered disruptive or any action or inaction which causes or could cause harm or put oneself or others in danger; injury to the school’s reputation; willful destruction of school property; theft/any illegal act.

- Students who exceed the maximum time frame shall be terminated from the program once maximum time frame has been reached. See SAP: Maximum Time Frame and Extra Instructional Charges Policy for more information.

The refund policy applies to all terminations for any reason.

Official Withdrawal Policy and Procedures

Students who withdraw from enrollment will receive a fair and equitable assessment of fees according to the Refund Policy dictated in the Enrollment Contract. The institution ensures that all online hours have been entered and are correct prior to completing any R2T4 and/or institutional refund calculation.

Official Withdrawal Procedure:

If a student wishes to request withdrawal from the program, the student must:

1. Provide notification to the school via email to f[email protected].

2. You may be requested to:

a. Review and sign withdrawal balance/refund calculation (for calculation purposes: the date of withdrawal is the last date of

attendance; the date of determination of withdrawal is the date the student notified the school of withdrawal)

b. Pay balance owed (if applicable)

c. Complete student loan exit counseling (if applicable).

d. Submit practical sheets

e. Sign off on actual hours completed

3. If student is owed a refund, the refund will be issued within 40 days from the date of determination of withdrawal. Student may contact Sherry Jansen, Chief Financial Officer at sjansen@chrysm.edu for status update on refund check. If refund check is issued, student must sign acknowledgement of Refund Receipt.

Per the U.S. Department of Education, the date of withdrawal is the student’s last date of attendance in all withdrawal and refund calculations. The date of determination the earlier of the dates that: the student notifies the school in person; written notification, the date said notification is delivered to the school in person, the date of termination by the school OR; after the student has missed fourteen (14) calendar days.

Students who withdraw prior to completion of the course, and wish to re-enroll will return in the same satisfactory academic progress status as of the time of withdrawal. See the Admissions Policy for more information on returning after withdrawal. See Refund Policy for further details about withdrawal and withdrawal settlements.

Official Withdrawal Procedure:

If a student wishes to request withdrawal from the program, the student must:

1. Provide notification to the school via email to f[email protected].

2. You may be requested to:

a. Review and sign withdrawal balance/refund calculation (for calculation purposes: the date of withdrawal is the last date of

attendance; the date of determination of withdrawal is the date the student notified the school of withdrawal)

b. Pay balance owed (if applicable)

c. Complete student loan exit counseling (if applicable).

d. Submit practical sheets

e. Sign off on actual hours completed

3. If student is owed a refund, the refund will be issued within 40 days from the date of determination of withdrawal. Student may contact Sherry Jansen, Chief Financial Officer at sjansen@chrysm.edu for status update on refund check. If refund check is issued, student must sign acknowledgement of Refund Receipt.

Per the U.S. Department of Education, the date of withdrawal is the student’s last date of attendance in all withdrawal and refund calculations. The date of determination the earlier of the dates that: the student notifies the school in person; written notification, the date said notification is delivered to the school in person, the date of termination by the school OR; after the student has missed fourteen (14) calendar days.

Students who withdraw prior to completion of the course, and wish to re-enroll will return in the same satisfactory academic progress status as of the time of withdrawal. See the Admissions Policy for more information on returning after withdrawal. See Refund Policy for further details about withdrawal and withdrawal settlements.

Re-Entry Policy

Return to Title IV (R2T4)

The Department of Education specifies how your school must determine the amount of Title IV program assistance that you earn if you withdraw from school. The Title IV programs that are covered by this law are: Federal Pell Grants, Stafford Loans, PLUS Loans, Federal Supplemental Educational Opportunity Grants (FSEOGs), Federal Perkins Loans.

When you withdraw during your payment period, the amount of Title IV program assistance that you have earned up to that point is determined by a specific formula. If you received (or your school or parent received on your behalf) less assistance than the amount that you earned, you may be able to receive those additional funds. If you received more assistance than you earned, the excess funds must be returned by the school and/or you.

The amount of assistance that you have earned is determined on a pro rata basis. For example, if you are scheduled to complete 30% of your payment period, you earn 30% of the assistance you were originally scheduled to receive. Once you are scheduled to have completed more than 60% of the payment period, you earn all the assistance that you were scheduled to receive for that period.

If you did not receive all of the funds that you earned, you may be due a post-withdrawal disbursement. If the post-withdrawal disbursement includes loan funds, you may choose to decline the loan funds so that you don't incur additional debt. Your school may automatically use all or a portion of your post-withdrawal disbursement (including loan funds, if you accept them) for tuition, fees, and room and board charges (as contracted with the school). For all other school charges, the school needs your permission to use the post-withdrawal disbursement. If you do not give your permission, you will be offered the funds. However, it may be in your best interest to allow the school to keep the funds to reduce your debt at the school.

If a student earned more aid than was disbursed to him/her, the institution would owe the student a post-withdrawal disbursement. From the date the institution determined the student withdrew, grant funds must be paid within 45 days and loan funds must be paid within 180 days.

Return of Unearned Aid is allocated in the following order:

1. Unsubsidized Federal Stafford Loan

2. Subsidized Federal Stafford Loan

3. Federal Perkins Loan

4. Federal Parent (Plus) Loan

5. Federal Pell Grant

6. Federal Supplemental Opportunity Grant

7. Other Title IV Assistance

There are some Title IV funds that you were scheduled to receive that you cannot earn once you withdraw because of other eligibility requirements. For example, if you are a first-time, first-year undergraduate student and you have not completed the first 30 days of your program before you withdraw, you will not earn any FFEL or Direct loan funds that you would have received had you remained enrolled past the 30th day.

Title IV Future Professionals reentering within 180 days of withdrawal date will resume at the same status as prior to withdrawal.

If you receive (or your school or parent receive on your behalf) excess Title IV program funds that must be returned, your school must return a portion of the excess equal to the lesser of:

1. Your institutional charges multiplied by the unearned percentage of your funds, or

2. The entire amount of excess funds.

The school must return this amount even if it did not keep this amount of your Title IV program funds.

If your school is not required to return all of the excess funds, you must return the remaining amount. Any loan funds that you must return, you (or your parent for a PLUS Loan) repay in accordance with the terms of the promissory note. That is, you make scheduled payments to the holder of the loan over a period of time.

Any amount of unearned grant funds that you must return is called an overpayment. The amount of a grant overpayment that you must repay is half of the received amount. You must make arrangements with your school or the Department of Education to return the unearned grant funds.

The requirements for Title IV program funds when you withdraw are separate from the institutional refund policy. Therefore, you may still owe funds to the school to cover unpaid institutional charges. Your school may also charge you for any Title IV program funds that the school was required to return. The institution’s refund policy is located in the catalog and catalogs are provided to students prior to enrollment. You may also request the requirements and procedures for withdrawing from school, officially, from the Office of Administration.